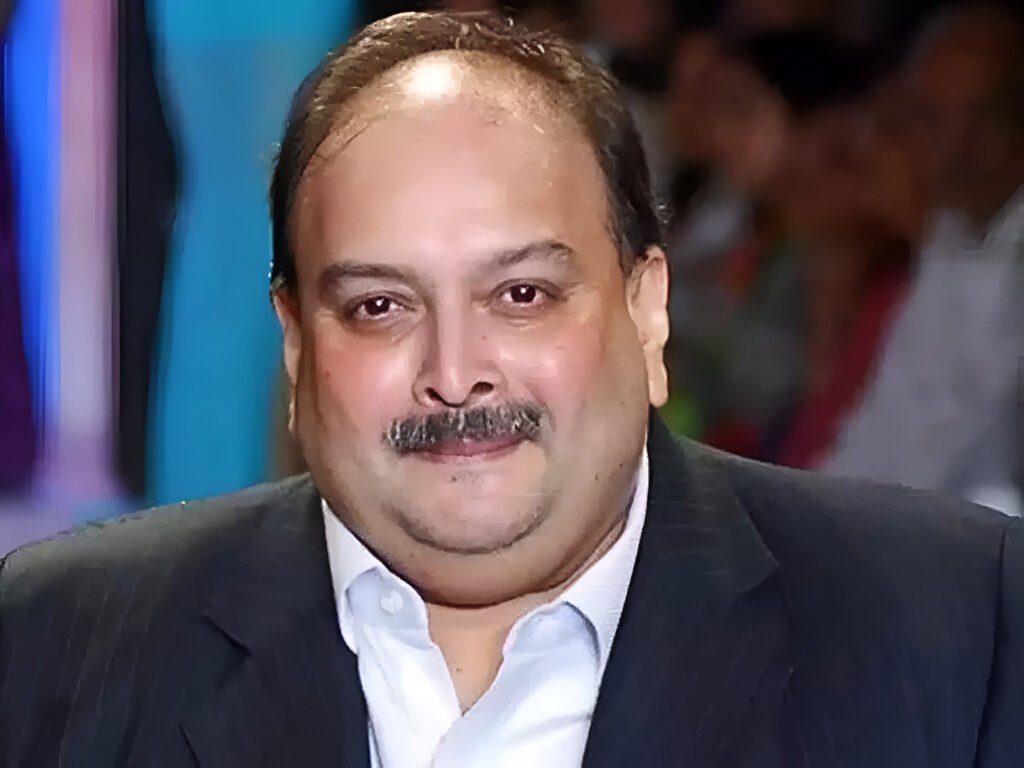

The Story Behind Mehul Choksi’s Orchestration of the Scam Worth ₹13,500 Crore: Punjab National Bank Scandal

Scams involving banking institutions have become prevalent in the second decade of the 21st century, especially in India. One of the most well-planned and, at the same time, financially devastating scams for India is the PN Bank scam disclosed in 2018. Gitanjali Group’s owner Mehul Choksi and his nephew Nirav Modi are known for designing this scam, which not only resulted in loss of reputation for the India banking system but also cost it around ₹ 135 billion. Following is an overview of the scheme in detail, including how it was carried out, the aftermath, and wider socio-economical effects.

Conduct Encompassed In Scam Execution

While serving as the Managing Director for Gitanjali Group till 2017, Choksi managed to get PNB bank’s corporation practice papers. To augment those papers, he worked with several junior level PNB employees to provide brcc Ketern Diplomas of Army Commanders as well as school Charles Menteu Sait to obtain LoUs and FLCs which were completely unobtained. Without following internal protocols, they were able to defraud existing loans on international funds which set a dangerous precedent for other banks as well.

Method of Operation: Taking Advantage of Banking Loopholes

The illegal actions revolved around the abuse of LoUs and the use of the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system. With the help of PNB protesting accomplices, Choksi’s businesses LoUs with no security or documents to cover the loan. The issued LoUs were sent through the SWIFT system to other Indian banks’ foreign branches, enabling them to give out funds. Most importantly, these transactions left out PNB’s core banking system, allowing the scam to persist undetected for years.

A forensic audit later highlighted how these companies were dealt with on a minimalistic basis since they only held an operating account with PNB alongside devoiding non-visible features, where none were captured through a centralised banking interface. Such intent of inaction only served to make a covert structure less functional under the supervision of regulators.

Legal follow ups: Worldwide contractors and sub-contractors receiving work orders through different methods of communications made hierarchically vertical companies legal entities of the Republic of P.

The fraud was first detected when PNB officials began observing discrepancies in the issuance of LoUs. Further investigations followed, leading to complaints by PNB employees directed to the Central Bureau of Investigation (CBI) accusing Choksi, Modi, and a whole bunch of PNB staff. Both Choksi and Modi escaped the country before the scheme was brought to light.

Choksi’s arrest in Belgium in April 2025 triggered a wave of extradition requests set forth by Indian officials, which was a marked improvement in the stagnated legal activities concerning the scam, enhancing the proceedings substantiated in hope the funding is located. His arrest subsequently complicated extradition efforts as he acquired citizenship in Antigua and Barbuda in 2017.

Impact on India’s Banking Sector

The PNB Banking Industry was deeply impacted by the PNB Financial Scam and suffered damage in numerous LoU issued and controlled by the Indian banking system. As a consequence, the Indian Reserve Bank removed the Letters of Comfort and LoU from their registered instruments of trade credit in March of 2018.

Also, the Indian economy introduced the new bill of Fugitive Economic Offenders. The purpose of this bill is preventive in stance as it seeks to deter offenders with the threat of asset confiscation if the process is evaded . This was to further fortify the legislation of financial fraud in hoping increased violations of fraud will equate to better enforcement in detecting governance within the India Banks.

Conclusion: Lessons learned and the Road Ahead

The PNB Financial Scam set forth by Mehul Choksi acts as an emergent event focusing attention needing lack of internal rotary fabric composed of clear and robust controls which lends the phenomena of enforced external scrutiny to increase vigilance, transparency and accountability in finance institutions. The case propels the necessity of regulating frameworks and red tape devoid systems sustains as a principle guiding nation which serves as an enquiry illustration.